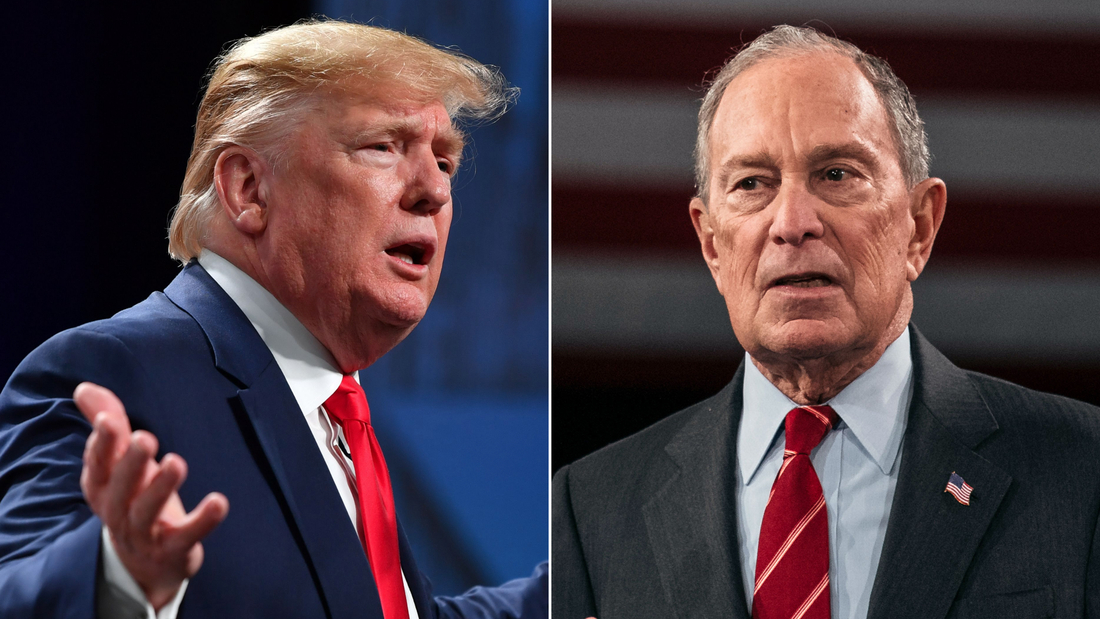

FS: Bloomberg is blowing every person else out of the water. American national politics has actually never ever seen anything fairly similar to this.

Since Friday early morning, the previous New York city mayor had actually raked virtually $386 million right into marketing alone, according to a tally by Kantar Media’s Campaign Media Analysis Group. That’s TWICE the marketing costs of the various other billionaire in the race, Tom Steyer, that had actually invested simply north of $186 million.

As well as consider this: Bloomberg went into the race just a bit greater than 2 months earlier. We ain’t seen absolutely nothing yet.

No limitations to self-financing

ZW: How a lot can he invest? Exists anything in United States legislation that resolves self-financing?

FS: As high as he desires. Federal prospects do not deal with any kind of constraints on just how much of their very own cash they can invest to win– or shed– a political election.

Back in 2002, Congress tried to level the having fun area in between self-funded legislative prospects and also their opponents in this manner: Once a self-funded prospect’s costs went across an established limit ($ 350,000 for House prospects, as an example), payment limitations for all the various other competitors in the race would certainly be kicked back.

However the United States Supreme Court threw out that arrangement as unconstitutional in 2008. As well as the courthas stated abundant prospects have a First Amendment right to “unconfined speech.”

No control

ZW: Bloomberg has actually claimed he will certainly invest millions to beat Trump also if he sheds the key. What are the limitations on exactly how he can invest to aid the candidate if it isn’t him?

FS: There are no restrictions on just how much he can invest to aid one more prospect. The courts have actually ruled that independent gamers in national politics additionally have free-speech legal rights in political elections.

He would certainly, nonetheless, face limitations on collaborating his costs choices with the ultimate Democratic candidate.

Consider it in this manner: Bloomberg can not GIVE Amy Klobuchar’s project $1 million if she were the Democratic candidate neither story with her project concerning exactly how to invest $1 million, since that would certainly go beyond the $2,800 general-election payment limitation.

However he can SPEND $1 million on TELEVISION commercials, prompting individuals to choose her.

Producing a story

ZW: What will Bloomberg get with all that cash? Individuals do not simply choose the prospect with one of the most cash. They still need to be encouraged. What’s the disagreement that the cash amounts to an unjust benefit?

FS: Bloomberg’s unrelenting costs early in the race enables him to produce a narrative regarding himself while his competitors are hectic combating each other for the election.

For example, a Facebook buddy just recently composed in my feed that previous President Barack Obama had actually backed Bloomberg! That’s not real. Obama hasn’t supported any person in the key, not also his previous vice head of state, Joe Biden.

Yet Bloomberg and also his group shrewdly developed a 30-second advertisement proclaiming his partnership with the previous two-term head of state.

( It’s unclear the length of time Bloomberg will certainly continue to be in control of the story, as he has actually been compelled to challenge disputes over problems like his policing plans in New York.)

All the various other billionaires

ZW: There are lots of billionaires that wish to affect national politics. Sheldon Adelson, the Las Vegas online casino mogul, will certainly open his pockets to aid Trump. What’s the distinction in between exactly how he can invest in part of Trump as well as just how Bloomberg can invest in part of himself?

FS: If past is beginning, Adelson will certainly unload millions right into outdoors teams– incredibly PACs as well as political nonprofits– to aid the President. He goes through regulations that forbid working with choices on investing with Trump and also his project.

Federal government funding

ZW: I still obtain that concern on my income tax return concerning whether I intend to add to government funding for projects. Can Bloomberg or Trump or any type of Democrat still get that aid?

FS: The public-financing system gets on life assistance.

Prospects do not utilize it due to the fact that they have to abide by stringent costs limitations if they take public funds. As well as in an age of limitless political investing, no significant governmental prospect would certainly kneecap their very own project because style.

In the 2016 governmental race, just 2 prospects obtained public funds: previous Maryland Gov. Martin O’Malley, that looked for the Democratic election, and also Green Party prospect Jill Stein.

Sen. Joni Ernst, an Iowa Republican, has actually recommended getting rid of the fund and also making use of the greater than $350 million being in the account to decrease the government deficit spending.

Super PACs

ZW: In current years we have actually covered extremely PACs thoroughly. Will they still play a vital function in 2020?

A variety of governmental prospects, such as Sen. Elizabeth Warren of Massachusetts, have actually knocked incredibly PACs as well as claim they do not desire their assistance. However these teams likely will play a bigger function once the basic political election remains in full speed.

Biden, for example, disavowed very PACs at the beginning of the political election cycle, just to unlock to one such team as his project had a hard time to acquire grip.

However now, as a result of the outsized costs by the billionaires in Democratic area, prospect costs is overloading the cash invested by outdoors teams as well as extremely PACs.

Company money

ZW: Warren as well as Bernie Sanders have actually made a large program of not taking cash from specific business benefactors. Does this mean they will not approve aid beating Trump in November if either of them wins the key?

We’ll need to see just how this plays out. Both prospects have actually been rather solid concerning avoiding business cash in their projects; it’s constructed right into their brand names.

Yet make indisputable: The Democrats’ ultimate candidate will certainly not harm for cash money. Autonomous benefactors are discharged up. In 2015, small-dollar benefactors provided $1 billion to Democratic prospects as well as liberal reasons with the online system ActBlue. The floodgates will certainly open up for the candidate.

Profits price: Billions

ZW: How a lot, at the end of the day, is this governmental project mosting likely to set you back?

FS: More than ever in the past. However it’s difficult to select a precise number.

The 2016 race price concerning $2.4 billion, according to an evaluation by the detached Center for Responsive Politics, which tracks political investing. (That was really a dip from the previous political election, in 2012; Trump’s investing in 2016 was reasonably small.)

There will certainly be absolutely nothing small concerning the 2020 race. Trump as well as his allies are elevating big amounts for his reelection. And also Bloomberg has actually not dismissed investing $1 billion to beat Trump, also if the previous New York mayor falls short to win the Democratic election.

Cash leaders

ZW: Excluding Bloomberg, does Trump presently have a fundraising benefit over Democrats or the other way around?

FS: Trump is increasing a great deal of cash and also is running in advance of the majority of Democrats due to the fact that he obtained a very early beginning. He declared reelection the day he was vouched right into workplace in January 2017.

Today, Trump’s project revealed that he had actually increased collectively with the Republican National Committee greater than $525 million because the beginning of 2019. The teams had greater than $200 million in offered money, heading right into the basic political election. As well as they’re simply getting going. Trump as well as the RNC are holding a charity event in Florida near Mar-a-Lago that will certainly set you back benefactors $580,600 per pair.

Besides the billionaires, no person in the Democratic area has that type of cash accumulating in their battle breasts.

Not a system, a jumble

ZW: If every American could understand one point concerning project financing regulation, what should it be?

FS: It’s ALRIGHT to be puzzled by it because today the system is a jumble quilt of legislations and also court judgments.

Original Source: https://ift.tt/2OX5VpO