The U.S. is facing what is most likely to be the most dangerous week up until now in the coronavirus break out and with over 10 million brand-new joblessness claims over the previous 2 weeks the background for the real estate market is relatively bleak.

Yet in some way the stability in home-buying need we saw recently has actually extended into today.

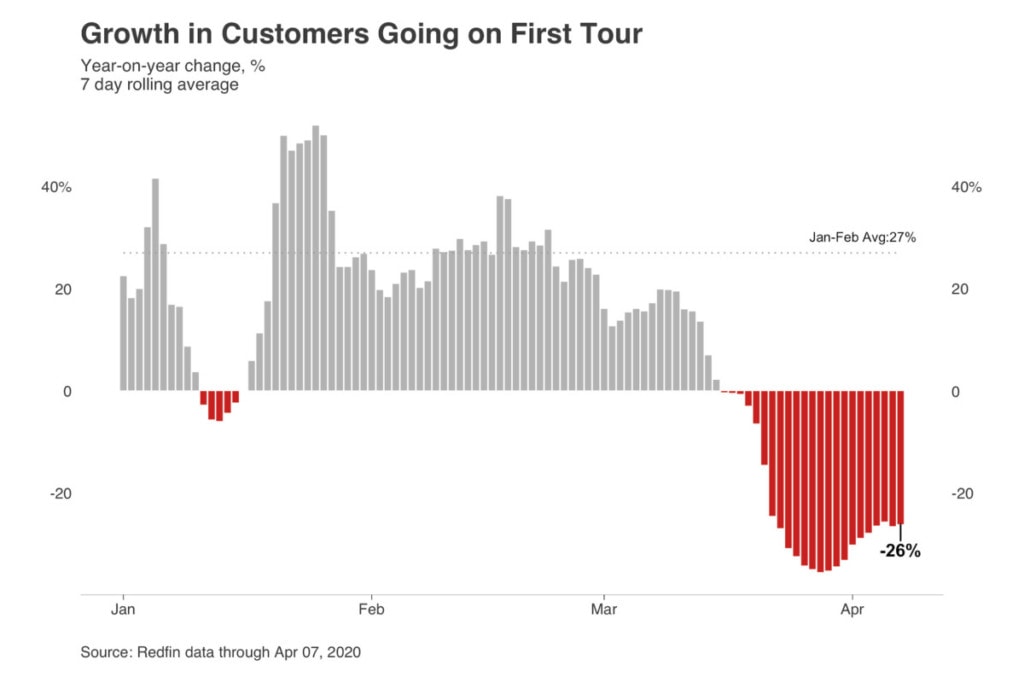

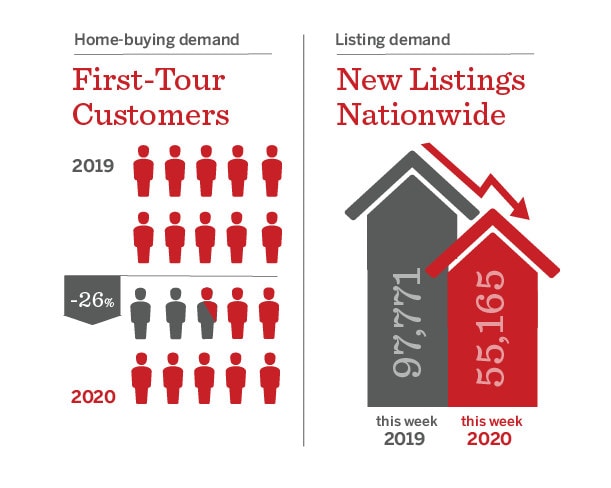

We determine home-buying need by the yearly development rate in clients going on their very first trip with a Redfin representative. For the 7 days ending April 7, home-buying need was down 26% compared to the previous year.

It was down 33% compared to the previous year when we reported on this number last week. Most of the enhancement from recently is an outcome of Redfin routing a bigger share of consumer questions from Redfin.com to our own representatives, referring less queries to our partner representatives .

The current stability is motivating after numerous weeks of free-falling home-buying need; in January and February Redfin’’ s home-buying need was up 27 %compared to the previous year.

The durability in home-buying need might be driven by the current rally in the stock exchange which acquired 20% given that it bottomed out on March 23, by low home mortgage rates which are now back listed below 3.5%, or by the basic lure of getting an offer, ” stated Redfin lead economic expert Taylor Marr .

But till we” see a continual nationwide downturn in brand-new COVID-19 infections, healthcare facility admissions, and deaths, it ’ s prematurely to state if we ’ ve reached the bottom for home-buying need. ”

Personal Safety Concerns Accelerate the Move to a Virtual World

Getting access to a residential or commercial property for in-person provings is getting significantly made complex as purchasers, sellers, and representatives all increase security preventative measures. Miriam Westberg, a Redfin representative in San Francisco stated, “ Every home is now like a high-end listing.

Purchasers require to be pre-approved with a respectable lending institution and most noting representatives will ask 20 concerns to see how “severe they are prior to they can stroll through the door.

Sellers are leaving closets and cabinets open for a touchless trip, representatives are wearing gloves and masks, and in California potential purchasers need to sign a type licensing that they don’t have coronavirus.

More and more, purchasers are deciding to visit the house from another location by means of video chat with either their representative, the seller, or in some cases even an occupant transmitting the interior of your house back to the purchasers ’ living space.

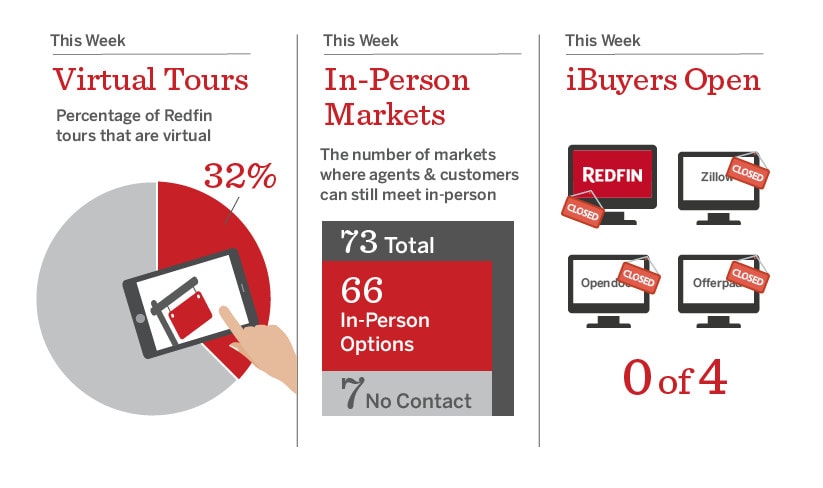

Last weekend 32% of Redfin trip demands were for video-chat trips , up a little from 30% of trip demands the previous weekend.

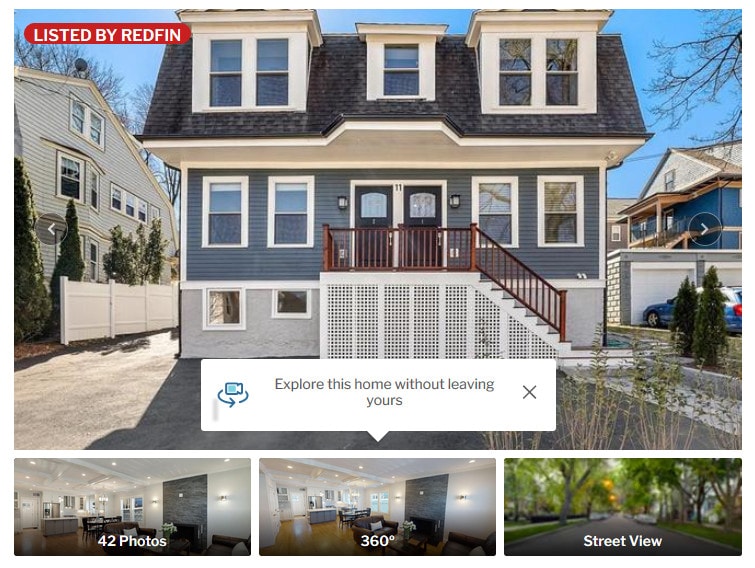

On April 2, we made it much easier for potential purchasers to see Redfin listings online, highlighting our virtual walkthroughs front and center on Redfin.com. The variety of everyday click our virtual walkthroughs have more than doubled given that we upgraded our website.

For purchasers who desire a real-time proving, however aren ’ t prepared to set up a personal proving, we ’ ve moved the open home online.

Last weekend we live-streamed 10 open homes with purchasers directing the listing representative which spaces to check out by text chat.

This is a small portion of the houses Redfin has for sale, however simply a couple of weeks ago video-chat trips were just.2% of our trip demands .

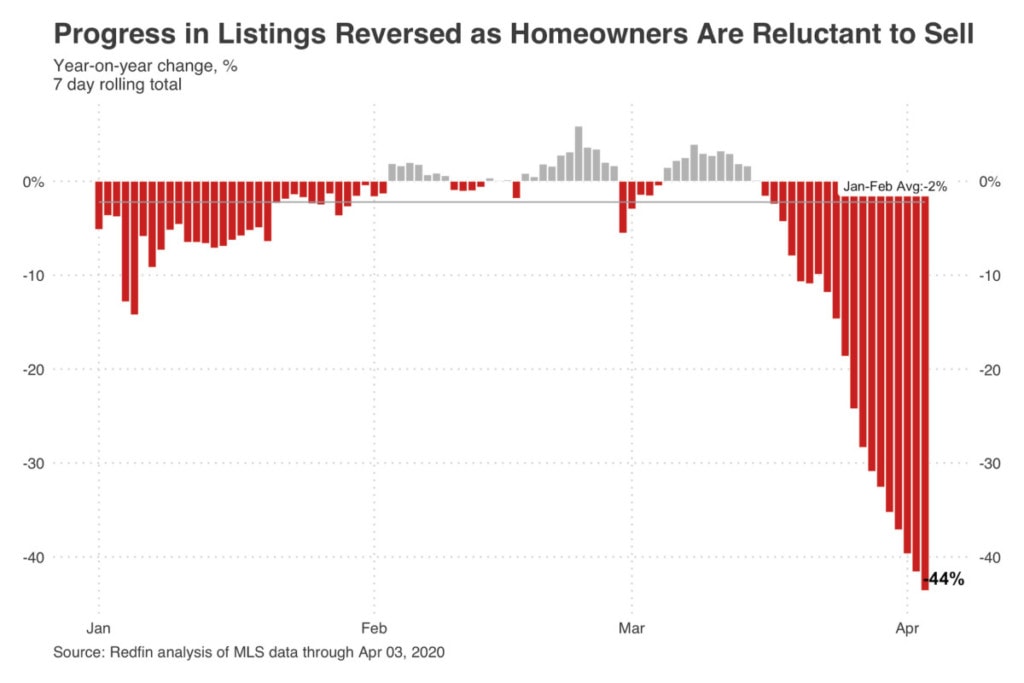

Most Sellers Are Sitting This Spring Out

Nationwide, brand-new listings are down 44% compared to the previous year for the 7 days ending April 3. That ’ s a substantial pullback compared to the 33% decrease we reported recently and there ’ s no indicator this pattern will reverse anytime quickly.

The huge concern is whether sellers will have the ability to wait up until stay-at-home orders are raised.

Redfin representatives report that lots of sellers wish to list in early to mid-May, however it ’ s still uncertain whether the orders will be raised already.

Some sellers might not have the ability to wait anylonger if they ’ ve currently moved or their household just doesn ’ t fit in their old house any longer.

But some sellers are pushing forward regardless of the stay-at-home’constraints. Sylva Khaylian, a Redfin representative in Los Angeles reported that a great deal of her sellers are concerned rates will be lower later on and simply wish to get on with it.

We talked to 16 Redfin customers this previous week and just one-third of them felt great about their sale. Customers with houses in extremely preferable or inexpensive areas still felt the marketplace remained in their favor.

Sales Down, Prices Flat

With less houses to pick from, pending U.S. house sales are down 49 %in the 7 days ending April 3.

Now we ’ re getting our very first view into closed sales considering that the pandemic started, which were just down 13% for the seven-day duration ending March 28.

We anticipate the weak point in pending sales to infect closed sales as April advances.

It ’ s still a little prematurely to take a look at the effect of the pandemic on sale rates, however the average rate for brand-new listings has actually been up to $309,000 from $330,000 previously this year.

Mean listing rates are now flat with in 2015 after being up almost 8% at the peak in early March.

A few of the cost decrease is because of a larger downturn in the high-end market, with’houses above $750,000 just representing 8% of brand-new listings given that mid-March compared to 9% in the previous year.

Surprisingly, we ’ re still not seeing a boost in cost decreases compared to the very same time in 2015.

Instead of decreasing the rate, sellers might be pulling their houses off the marketplace to await a much better time.

Sellers were two times as most likely to withdraw from the marketplace in the 7 days ending April 3 as they were at the very same time in 2015.

A New Kind of Bidding War

Despite the decrease in pending sales, the mix of less brand-new listings and more sellers revoking the marketplace suggests that the variety of houses for sale is now down 19% compared to in 2015. When we reported this recently it was down 17%.

MaryDell Penney, the Redfin Market Manager in North Florida stated the marketplace for budget-friendly houses continues tobe competitive, associating the strength inthat sector of the marketplace to low rates of interest.

Competitors for budget friendly houses is a belief we heard echoed by Redfin representatives throughout the nation.

But the bidding wars aren ’ t the 10-offer,$ 50,000 dollars-over-list-price fight royales we saw previously in the year.

Leslie White, a Redfin representative in Washington D.C., stated a deal at sale price and an individual letter to the seller sufficed to vanquish 2 other purchasers.

Her purchasers had actually consisted of an escalation provision to instantly increase the cost of their deal if another deal can be found in at a greater cost, however they didn ’ t requirement to utilize it.

Keep an Eye on the Mortgage Market

Rates for a 30-year home mortgage have actually hung back to 3.4% since April 6, however there has actually been a disruption in the home mortgage force.

Some loan providers have stopped making jumbo loans for expensive houses, mentioning a considerable decrease in financiers ready to’buy those loans.

The huge banks like Wells Fargo are still making jumbo loans, and now need 20% down-payments .

At the other end of the marketplace, lots of loan providers have likewise stopped coming from Federal Housing Administration (FHA) loans .

Since they let purchasers put as little as 3.5% down and are more lax for customers with lower credit ratings, FHA loans are frequently utilized by novice property buyers.

Lenders and federal government regulators alike have actually begun to stress that an increasing portion of newbie purchasers might not have the ability to make their regular monthly payments as the economy continues to stagger under the weight of the coronavirus.

That’s it for today.

Please remain safe, and if you can, stay at home. Please accept the most genuine thanks from everybody here at Redfin if you ’ re out on the front lines.

Original Source: Surprising Resilience in Home-Buying Demand Despite Job Losses and Coronavirus Spread

Curated On: https://www.cashadvancepaydayloansonline.com/

The post Surprising Resilience in Home-Buying Demand Despite Job Losses and Coronavirus Spread In 2020 appeared first on Instant Cash Advance Loans 2020 | Instant Advance Payday Loans 2020.

source https://www.cashadvancepaydayloansonline.com/surprising-resilience-in-home-buying-demand-despite-job-losses-and-coronavirus-spread-in-2020/?utm_source=rss&utm_medium=rss&utm_campaign=surprising-resilience-in-home-buying-demand-despite-job-losses-and-coronavirus-spread-in-2020

No comments:

Post a Comment